Introduction

The rise of electric cars is no longer a trend — it’s a global movement. With environmental concerns at an all-time high and a push for cleaner, more sustainable alternatives, electric vehicles (EVs) are stepping into the spotlight. If you’re looking for smart, long-term investments, electric cars should be at the top of your list. But why exactly should you invest in this rapidly growing sector? Well, there are several compelling reasons why electric cars are more than just a passing phase. In this post, we’ll reveal 7 compelling reasons why electric cars should be your next big move—and how they can boost your financial future.

1: The Global Push for Sustainability

Green Energy is the Future

The world is shifting towards sustainability, and the electric vehicle market is at the forefront of this transformation. Governments, corporations, and individuals are all increasingly adopting clean energy solutions. Electric cars are pivotal in this change, as they eliminate harmful emissions from fossil fuels, significantly contributing to cleaner air and reducing global carbon footprints.

With climate change and environmental degradation becoming more pressing, the demand for environmentally friendly solutions has never been higher. Investing in electric cars aligns you with this global push for a greener, more sustainable future.

Global Environmental Goals and Regulations

Countries across the globe are setting ambitious carbon reduction targets. The European Union, for example, has pledged to reduce carbon emissions by 55% by 2030 and aims to make all new cars zero-emission by 2035. Similarly, China and the United States are implementing stringent regulations to encourage electric vehicle adoption.

These regulations, combined with the global trend toward sustainability, make electric cars a strategic investment choice. The demand for EVs will continue to grow as countries push for stricter environmental standards.

2: The Growing Demand for Electric Vehicles

A Global Market Surge

The electric vehicle market is experiencing rapid growth. In 2020, global EV sales hit a record high, and they are expected to continue to rise as battery technology improves, and consumer awareness increases. More people are recognizing the environmental and financial benefits of electric cars, making them more likely to make the switch.

According to a recent report from the International Energy Agency (IEA), EV sales are expected to reach 40% of total car sales by 2030. This surge in demand presents significant opportunities for those looking to invest in a sector that shows no signs of slowing down.

Consumer Preferences Shifting Toward EVs

Consumer preferences are rapidly shifting in favor of electric cars. While traditional vehicles once dominated the market, EVs now offer a compelling alternative, especially with the growing availability of affordable models. Electric vehicles also offer a more modern and eco-friendly image, which resonates with younger, environmentally conscious buyers.

As more automakers enter the EV market and consumers become more familiar with the technology, the demand for electric cars is expected to skyrocket.

The Role of Emerging Markets

Emerging markets, particularly in Asia and Africa, are also seeing an increase in electric vehicle adoption. These regions are witnessing rapid urbanization, which is increasing air pollution levels. Governments are taking notice, introducing incentives to encourage EV adoption and reduce the environmental impact.

In these emerging markets, electric vehicles represent a huge investment opportunity. As infrastructure improves, and consumer demand rises, early investors in these regions are likely to see significant returns.

3: Government Support and Incentives

Tax Credits and Subsidies: Incentives for Electric Vehicle Adoption

One of the most compelling reasons to invest in electric cars is the financial incentives that come with them. Across the globe, governments are recognizing the need to promote cleaner, more sustainable transportation options, and Nigeria is no exception. While tax credits and subsidies for electric vehicles (EVs) are widespread in countries like the United States, Nigeria is also starting to introduce policies and incentives aimed at making EVs more affordable and accessible.

In Nigeria, the government has shown interest in transitioning from fossil fuel-powered vehicles to electric vehicles as part of its broader strategy to diversify its economy and reduce its reliance on oil. While tax credits specifically for electric vehicles are not yet as extensive as those in countries like the U.S., Nigeria’s government is beginning to offer targeted subsidies, grants, and tax reliefs to encourage EV adoption.

For example, Nigeria’s National Automotive Design and Development Council (NADDC) has supported local manufacturers producing electric vehicles by offering tax holidays and incentives for companies that set up assembly plants in the country. These initiatives are aimed at reducing the production costs of electric vehicles and making them more affordable for consumers.

Additionally, Nigeria’s growing focus on renewable energy, particularly solar power, presents opportunities for integrating clean energy solutions with electric vehicle infrastructure. The Nigerian government has introduced several initiatives to promote renewable energy adoption, which could potentially be expanded to include subsidies for installing EV charging stations powered by solar energy. This would not only make it easier for Nigerians to charge their EVs but also reduce the overall environmental impact.

For investors, the government’s support and commitment to promoting electric vehicles provides a level of stability and confidence in the market. The incentives and subsidies signal that the Nigerian government is serious about creating a sustainable, long-term market for electric vehicles. As the country moves toward a greener future, these incentives will continue to make electric vehicles more affordable for consumers, further driving adoption and creating new opportunities for businesses and investors in the EV space

Policies Supporting EV Adoption Worldwide

Governments are also implementing policies that promote EV adoption, such as banning the sale of new gasoline-powered cars in the near future. The United Kingdom, for instance, has announced plans to ban the sale of new gasoline and diesel cars by 2030, signaling a clear shift towards electric vehicles.

With the support of governments, the electric vehicle industry is well-positioned for growth. For investors, this means a stable, supportive environment in which EV manufacturers can thrive.

4: Technological Advancements Driving EV Prices Down

Battery Innovation and Affordability

One of the main reasons electric vehicles are becoming more affordable is advances in battery technology. Lithium-ion batteries, which power most electric vehicles, have become cheaper and more efficient over the years. Battery costs have dropped by over 85% since 2010, and this trend is expected to continue.

As batteries become more affordable, the overall price of electric cars will continue to decrease. This will make EVs accessible to a wider range of consumers, further driving demand.

Improvements in EV Range and Charging Speed

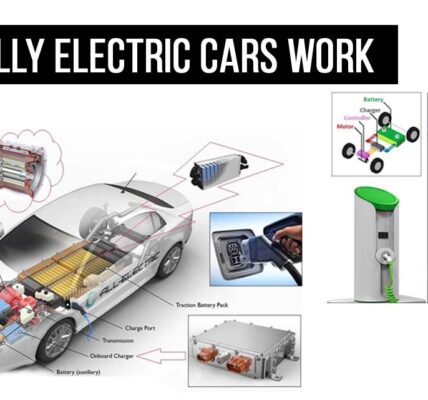

EV manufacturers are also making significant strides in improving the driving range and charging speed of electric vehicles. Today’s electric cars can travel longer distances on a single charge, and advancements in fast-charging technology allow drivers to charge their cars quickly and conveniently.

These improvements make electric vehicles more practical for everyday use and eliminate many of the concerns consumers had about range anxiety and charging times. As these technologies continue to evolve, the value of electric vehicles as an investment will only grow.

The Role of Automation in Reducing Manufacturing Costs

The automotive industry is also embracing automation, which is helping to reduce manufacturing costs. By utilizing robots and artificial intelligence, EV manufacturers can streamline production processes and lower costs. This makes electric vehicles more affordable for consumers and more profitable for manufacturers, creating a win-win situation for investors.

5: Electric Cars Are the Future of Transportation

Autonomous EVs and Their Investment Potential

The future of transportation is undoubtedly electric, but there’s another layer that’s becoming increasingly important: autonomous driving. While electric vehicles (EVs) provide a cleaner, more sustainable form of transportation, the integration of autonomous technologies will redefine how we think about travel. The potential of combining electric propulsion with autonomous driving technologies is profound — especially when you think about the future where self-driving EVs might dominate our streets.

In the case of electric cars, companies like Tesla and Waymo are already working on autonomous vehicles. They represent not just an investment in clean energy, but an investment in a transformative way of getting from point A to point B. The technological leap that autonomous EVs represent makes them particularly attractive to investors looking at long-term growth. As autonomous driving systems evolve, we will see a world where electric, self-driving cars are the norm rather than the exception. For investors, this means even greater growth potential, as the combination of these two technologies could open up a host of new markets and use cases.

In Nigeria, the market for autonomous electric vehicles may seem far off, but the trend toward technological advancements is already beginning to gain momentum. Although the Nigerian government is still primarily focused on developing infrastructure to support electric vehicles, the interest in autonomous technology is growing, especially in urban areas where traffic congestion is a significant issue. As Nigerian cities become more urbanized and demand for more efficient transportation solutions rises, the integration of autonomous features with electric vehicles might soon follow.

The Long-Term Viability of Electric Vehicles

When considering electric vehicles as a long-term investment, it’s essential to understand their role in the future of transportation. Electric cars are not just a passing trend or a niche market; they represent a significant shift in the automotive industry. Governments around the world are rapidly moving away from gasoline and diesel vehicles in favor of zero-emission alternatives. The European Union’s push to become carbon-neutral by 2050 and China’s massive investments in electric vehicle infrastructure are just the beginning.

For investors, the long-term viability of electric vehicles provides a strong case for investing now. In Nigeria, this viability is becoming increasingly apparent. With the Nigerian government looking to diversify its energy sources and reduce its dependency on oil — the primary source of the country’s economy — the shift to electric cars offers a pathway to a cleaner, more sustainable future.

Additionally, Nigeria’s rapidly growing urban population and the associated increase in transportation needs create a ripe environment for the adoption of electric vehicles. With rising fuel prices and concerns over air quality, electric cars present a viable alternative to the traditional combustion-engine vehicles, making them an attractive option for Nigerian consumers. The long-term growth potential of electric vehicles in Nigeria is tied to the nation’s broader economic and environmental goals.

How EVs Are Transforming the Automotive Industry

The electric vehicle revolution is not just a trend within the automotive industry — it’s transforming the entire sector. Traditional automakers are increasingly investing in electric vehicle development, with companies like Ford, General Motors, and Volkswagen committing to electrify their fleets in the coming years. Even luxury brands like Mercedes-Benz and BMW are unveiling plans to transition toward electric vehicles, making it clear that EVs are here to stay.

For Nigeria, the automotive industry’s shift toward electric vehicles presents both challenges and opportunities. While Nigeria has a strong history of being an oil-producing nation, its automotive sector has largely been dependent on imported vehicles, often internal combustion engine (ICE) cars. However, the advent of electric cars could spark a transformation in Nigeria’s automotive industry, with new opportunities for local manufacturers and partnerships with global electric vehicle producers. For example, Nigerian companies could establish manufacturing plants or assembly lines for electric vehicles, creating jobs and boosting local economies.

In addition, Nigeria’s rapidly growing tech sector, which is already home to a vibrant startup ecosystem, could serve as a breeding ground for innovation in the EV space. Nigerian tech companies could develop solutions tailored to the unique challenges of the local market, such as affordable battery storage systems, efficient charging infrastructure, and telematics for managing EV fleets in urban settings. By nurturing these innovations, Nigeria could emerge as a leader in the electric vehicle market in Africa.

The automotive industry in Nigeria is also seeing increasing interest in electric vehicles from international manufacturers looking to tap into emerging African markets. Companies such as Hyundai, BMW, and even Tesla have started to explore business opportunities in Africa. For investors, this signals that Nigeria is becoming a key player in the global electric vehicle landscape.

Challenges and Opportunities for Electric Vehicles in Nigeria

Despite the promising potential, Nigeria faces a series of challenges when it comes to fully adopting electric vehicles. One of the primary barriers is the lack of infrastructure, particularly the limited number of charging stations across the country. However, this also presents an opportunity for investment. Establishing a comprehensive network of EV charging stations could be a game-changer, particularly in urban areas like Lagos, Abuja, and Port Harcourt, where traffic congestion and pollution are major concerns.

Additionally, the high upfront cost of electric vehicles compared to traditional cars could be a deterrent for many Nigerians. However, with the reduction in battery costs and potential government incentives, EVs are becoming more affordable. The Nigerian government, recognizing the importance of this transition, is likely to roll out policies and subsidies to make electric vehicles more accessible to the general public.

In Nigeria, local automakers such as Stallion Group are already producing electric buses, showcasing the potential for electric vehicle manufacturing in the country. These efforts are still in the early stages, but they reflect a growing recognition of the economic and environmental benefits of electric transportation.

Furthermore, with the country’s abundant renewable energy potential — particularly solar power — the integration of electric vehicles and clean energy sources could play a pivotal role in Nigeria’s energy transition. Solar-powered EV charging stations are an exciting opportunity, particularly in rural and off-grid areas, where access to electricity is limited.

6: Financial Benefits of Owning an Electric Vehicle

Lower Maintenance Costs

One of the key financial benefits of electric cars is their lower maintenance costs. Unlike traditional cars, electric vehicles have fewer moving parts, meaning there is less that can go wrong. EVs don’t require oil changes, and their brakes last longer due to regenerative braking systems.

For investors, the lower maintenance costs of EVs make them a more attractive option, both for consumers and manufacturers. The reduced cost of ownership is one of the main factors driving the growing demand for electric vehicles.

Reduced Fuel Costs

Electric cars also have significantly lower fuel costs compared to traditional vehicles. Charging an EV is much cheaper than filling up a gas tank, and with the growing availability of home charging stations, drivers can save even more money.

This reduction in fuel costs makes electric cars an appealing option for consumers and investors alike, contributing to the overall growth of the EV market.

Long-Term Savings and Depreciation Benefits

While electric vehicles may have a higher initial purchase price, they offer long-term savings. Lower fuel and maintenance costs can result in significant savings over the life of the vehicle. Additionally, EVs tend to retain their value better than traditional cars, making them a smart long-term investment.

7: The EV Market Is Less Volatile Than Fossil Fuel Stocks

Stability Amid Oil Price Fluctuations

The electric vehicle market is less volatile than fossil fuel stocks, making it a safer investment option. Oil prices can fluctuate wildly due to geopolitical events, natural disasters, and other factors. In contrast, the demand for electric vehicles is driven by technological advancements, government policies, and consumer preferences, all of which are more stable and predictable.

For investors seeking a stable, long-term investment, the electric vehicle market presents an attractive alternative to the uncertainty of fossil fuel markets.

The Long-Term Investment Perspective

Investing in electric vehicles is a long-term play. As the industry matures and consumer adoption grows, the value of EV companies and technologies will continue to rise. With the backing of governments, improving technologies, and a growing consumer base, the electric vehicle market is poised for steady, sustained growth.

How to Get Started with Investing in Electric Cars

Direct Investments in EV Companies

One of the best ways to invest in electric cars is to buy stock in companies that manufacture electric vehicles, such as Tesla, Rivian, or NIO. These companies are leading the charge in the EV industry and are well-positioned for long-term growth.

Investing in EV-Related Technologies and Charging Networks

In addition to investing in EV manufacturers, you can also invest in companies that provide charging infrastructure or supply components for electric vehicles, such as batteries and charging stations. These companies stand to benefit as the demand for electric vehicles grows.

Stocks and ETFs in the EV Sector

Another way to invest in electric vehicles is through exchange-traded funds (ETFs) that focus on the EV sector. These funds invest in a diverse range of electric vehicle companies, offering exposure to the entire industry.

Conclusion

In conclusion, electric vehicles are not just an emerging trend — they are a significant part of the future of transportation. With government support, evolving technology, and increasing consumer interest, the electric vehicle market in Nigeria is growing rapidly and presents a strong opportunity for investors. The potential for growth spans beyond just EVs themselves, extending into sectors like charging infrastructure, renewable energy solutions, and local manufacturing.

As the world shifts toward sustainability, electric vehicles are positioned to lead the charge. But here’s something to think about: With Nigeria’s growing urbanization and environmental concerns, will the country fully embrace electric vehicles in the coming years? How can you, as an investor, tap into this emerging market now to ensure you’re part of Nigeria’s greener future? The time to act might be sooner than you think.

FAQ

1. Are electric cars a good investment for the average consumer? Yes, electric cars offer long-term savings through lower fuel and maintenance costs. They are also more environmentally friendly, which appeals to eco-conscious consumers.

2. How do government incentives affect electric car investments? Government incentives, such as tax credits and subsidies, make electric cars more affordable for consumers and increase demand, which benefits investors in the EV sector.

3. What are the best ways to invest in electric vehicles? Investing in EV companies, EV-related technologies, or stocks and ETFs focused on the EV market are great ways to capitalize on the growing industry.

4. How do electric vehicles compare to traditional cars in terms of maintenance? Electric vehicles have fewer moving parts and require less maintenance than traditional cars, leading to lower long-term costs.

5. Is investing in electric vehicles a stable option long term? Yes, the electric vehicle market is driven by long-term trends, such as sustainability and government policies, making it a more stable investment option compared to fossil fuel markets.

This is very informative.